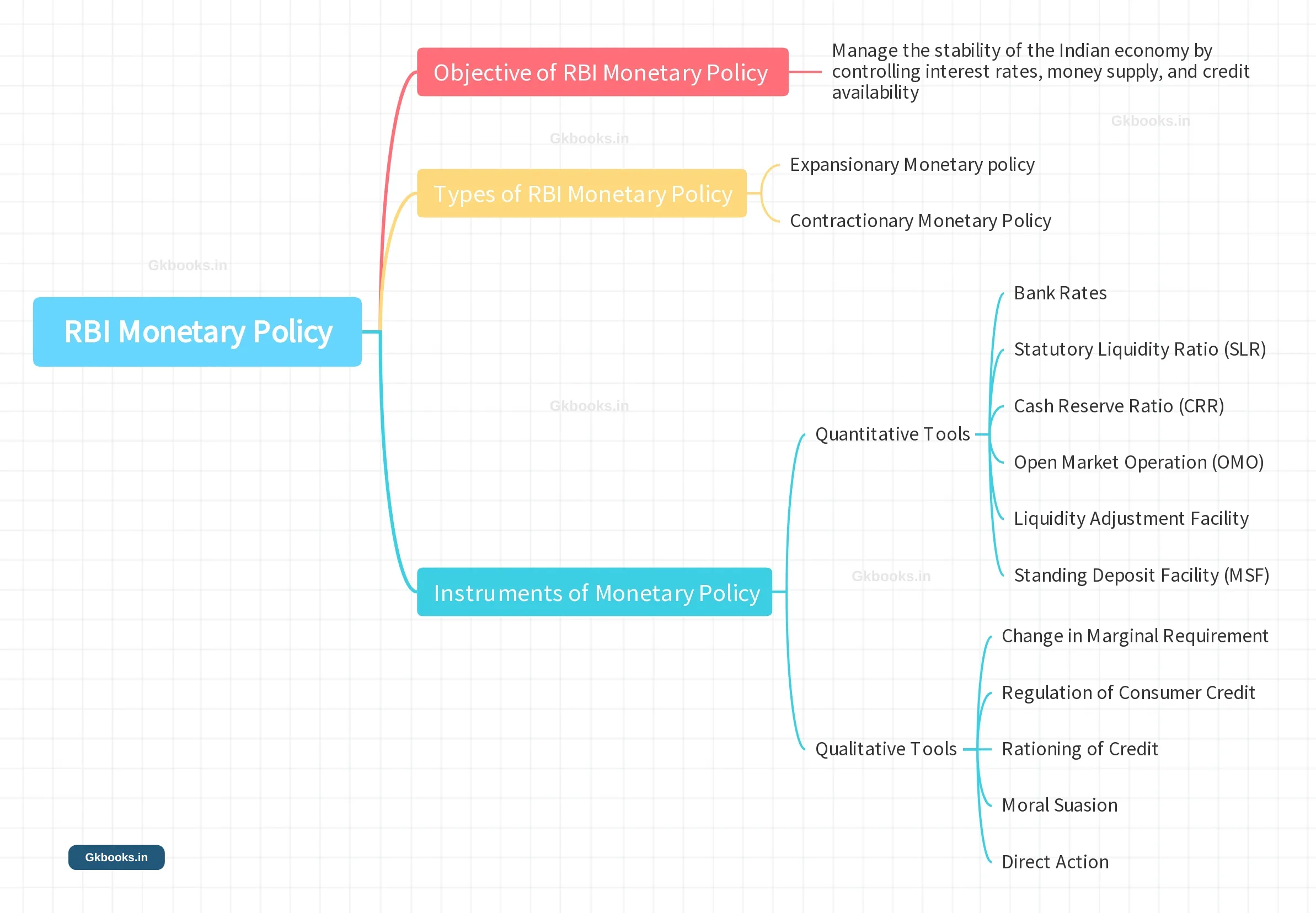

The Reserve Bank of India (RBI) plays a crucial role in regulating India’s monetary policy. This article covers the basics of RBI’s monetary policy, including its instruments, objectives, types, and more. Read on to learn about the different types of monetary policies, how the RBI implements them, and the impact they have on the Indian economy.

What is Meant by Monetary Policy?

▪ Monetary policy refers to the measures implemented by a nation’s central bank to regulate the flow of money in the economy with the aim of maintaining stability.

▪ Central banks use tools such as interest rates, reserves, and bonds to influence the money supply to achieve economic objectives, such as boosting employment, GDP growth, and price stability. In short, monetary policy is the process of adjusting the money supply to achieve stability and promote economic growth.

What is Meant by RBI Monetary Policy?

▪ Monetary policy of RBI refers to the actions taken by the central bank, in this case, the Reserve Bank of India, to manage the stability of the Indian economy by controlling interest rates, money supply, and credit availability.

▪ In summary, monetary policy is the use of monetary tools by the RBI to influence economic variables to achieve its overall economic goals.

▪ The Reserve Bank of India utilizes various instruments, such as the REPO rate, Reverse REPO rate, SLR, and CRR, to attain its broader economic objectives.

Objectives of Monetary Policy

▪ Both monetary and fiscal policies are critical components of economic management and play a key role in promoting economic growth and resilience.

▪ While fiscal policy deals with government spending and revenue, monetary policy focuses on regulating the money supply to improve employment, GDP, price stability, and national demand.

▪ A central bank’s monetary policy can influence the demand in the economy, however, it cannot affect the supply.

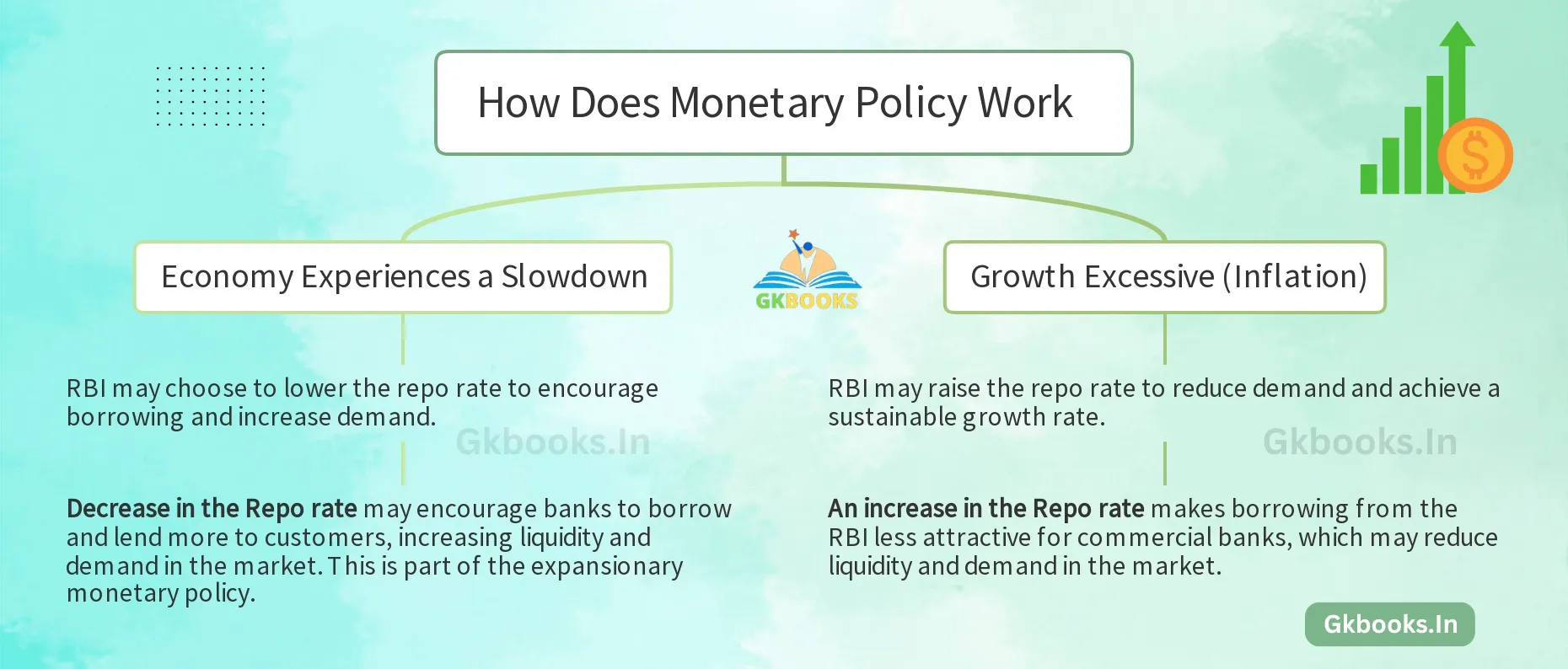

▪ When growth slows, the central bank may opt to lower the repo rate, which would lead to a decrease in loan rates throughout the economy and thereby boost demand.

▪ In cases where growth is excessive, causing inflation, the central bank may raise the repo rate in an attempt to reduce demand and bring about a “soft landing” by slowing down growth to a sustainable rate. A failure to address the overheating economy may result in a “hard landing” where growth drops significantly below its potential.

How Does Monetary Policy Work

▪ When the economy experiences a slowdown, the central bank may choose to lower the repo rate to encourage borrowing and increase demand.

▪ Conversely, if growth becomes excessive and results in inflation, the central bank may raise the repo rate to reduce demand and achieve a sustainable growth rate through a “soft landing.”

▪ In short, the basic concept behind the monetary policy is that by reducing the money available to consumers, their purchasing power will decrease, leading to lower demand and ultimately, a reduction in prices.

▪ To achieve this, various measures are employed, including adjustments to interest rates, reserve requirements of banks, and open market transactions.

Types of Monetary Policy

▪ Monetary policy refers to the measures implemented by a country’s central bank to regulate the flow of money in the economy. The purpose of controlling the money supply is to manage inflation or deflation. The actions taken by the central bank can result in two types of monetary policy: expansionary or contractionary.

Expansionary Monetary policy

▪ During economic slowdowns, the central bank may employ expansionary policies such as purchasing short-term government securities, reducing borrowing rates, and decreasing reserve requirements for banks.

▪ These measures aim to increase the money supply in the economy and stimulate consumer spending, ultimately reducing unemployment. However, this increased money supply can lead to inflation.

Contractionary Monetary Policy

▪ The central bank may implement contractionary monetary policies to regulate economic conditions, particularly inflation, by reducing the money supply in the financial system.

▪ This can be achieved by selling short-term government securities, increasing borrowing rates, or raising the reserve requirements for banks.

Difference between Contractionary and Expansionary Monetary Policy

| Contractionary Monetary Policy | Expansionary Monetary Policy |

|---|---|

| Reduces money supply in the economy | Increases money supply in the economy |

| Raises borrowing rates | Lowers borrowing rates |

| Increases banks’ reserve requirements | Decreases banks’ reserve requirements |

| Sells off short-term government securities | Buys short-term government securities |

| Aimed at controlling inflation | Aimed at boosting economic growth and reducing unemployment |

Instruments of Monetary Policy in India

▪ The monetary policy of the Reserve Bank of India encompasses two main categories of tools:

1. Quantitative and

2. Qualitative measures

Quantitative Monetary Policy

What is Quantitative Monetary Policy?

▪ Quantitative monetary policy refers to the central bank’s use of measures that directly affect the money supply, such as reserve requirements and open market operations, to influence the economy.

▪ The Quantitative tools, also referred to as general tools, are associated with the quantity and volume of money. These instruments serve to regulate the overall amount of money and bank credit in the economy. They are indirect instruments used to influence the credit available in the economy, such as reducing the Statutory Liquidity Rate (SLR) to increase market liquidity or increasing the SLR to decrease it.

Objectives of the Quantitative Monetary Policy?

▪ The objective of quantitative monetary policy is to manage the growth of the money supply and achieve specific macroeconomic goals, such as controlling inflation, reducing unemployment, and stabilizing economic growth.

Qualitative Monetary Policy

What is Qualitative Monetary Policy?

▪ Qualitative monetary policy refers to the central bank’s use of measures that indirectly affect the money supply, such as changes in credit allocation policy, to influence the economic sector.

▪ Unlike quantitative measures, which directly control the growth of the money supply, qualitative measures aim to influence the demand for credit, which indirectly affects the money supply and economic activity.

▪ Selective instruments, also known as qualitative monetary policy instruments, are utilized by the central bank to differentiate between different uses of credit. They aim to prioritize credit supply for specific purposes such as favoring exports over imports or essential activities over non-essential ones. These instruments have an impact on both lenders and borrowers.

▪ Qualitative tools are utilized to differentiate between various types of credit, such as giving preference to exports over imports or the supply of essential credit over non-essential credit. This strategy impacts both borrowers and lenders, and it influences how credit is utilized in different sectors.

▪ For instance, the RBI can set caps on the amount of money that banks can lend to specific sectors of the economy, without affecting the total amount of money in circulation. Instead, the available funds are directed towards a particular direction.

Objectives of the Qualitative Monetary Policy?

▪ The objective of qualitative monetary policy is to influence the behaviour of banks and consumers, encouraging or discouraging borrowing, investment, and spending, in order to achieve specific macroeconomic goals such as price stability, full employment, and economic growth.

Quantitative Monetary Policy Instruments

Different Quantitative tools

▪ The RBI has a variety of quantitative tools at its disposal to manage the volume of money and liquidity through its monetary policy. These include:

- Bank rates

- Statutory Liquidity Ratio (SLR)

- Cash Reserve Ratio (CRR)

- Open Market Operation (OMO)

- Liquidity Adjustment Facility

- Standing Deposit Facility (MSF)

▪ Using these tools, the RBI can control the supply of money and regulate the liquidity in the economy to maintain stable prices and promote economic growth.

▪ Let’s briefly discuss all these tools one by one:

Bank Rate

▪ The Bank Rate is the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks, typically in the form of short-term loans.

▪ Commercial banks are not required to provide collateral when borrowing at the Bank Rate, and there is no obligation to repay on a specific date.

▪ The publication of the Bank Rate is governed by Section 49 of the Reserve Bank of India Act, 1934.

▪ The Bank Rate is linked to the MSF rate, so it adjusts automatically when the MSF rate or policy repo rate changes. Currently, as of April 22, 2023, the Bank Rate is set at 6.50% as part of the monetary policy.

Here is a summary of how the Bank Rate controls monetary policy: Lower Bank Rate ⇒ Cheaper to borrow money ⇒ More lending ⇒ Stimulates economic activity Higher Bank Rate ⇒ More expensive to borrow money ⇒ Less lending ⇒ Slows down economic activity

Statutory Liquidity Ratio (SLR)

▪ The Statutory Liquidity Ratio (SLR) is the minimum percentage of deposits, specifically the Net Demand and Time Liabilities (NDTL), that commercial banks are required to keep in reserve.

▪ This reserve can be held in the form of cash, gold valued at current prices, government securities, and treasury bills. Commercial banks are only allowed to hold government securities and are prohibited from investing in private stocks.

▪ The Reserve Bank of India has the authority to set and adjust the SLR in response to changing macroeconomic conditions. To control bank credit during times of inflation, the RBI raises the SLR, while during a recession, it reduces the SLR to promote bank credit.

▪ The CRR and SLR have traditionally been used by central banks to limit credit growth, liquidity flow, and inflation in the economy. If a bank fails to maintain the prescribed SLR, it is subject to penalties, with a penalty of 3% above the Bank Rate for the deficient amount for that particular day.

▪ The 2007 amendment to the Banking Regulation Act of 1949 removed the lower ceiling of SLR, allowing it to vary between 0-40% of the NDTL of the banks. Currently, as of December 2021, the SLR stands at 18.00% of the NDTL of the banks.

Summary of how the SLR controls monetary policy: Higher SLR ⇒ Less money available to lend ⇒ Slows down economic growth Lower SLR ⇒ More money available to lend ⇒ Stimulates economic growth

Cash Reserve Ratio (CRR)

▪ The Cash Reserve Ratio (CRR) is the minimum percentage of total deposits, specifically the Net Demand and Time Liabilities (NDTL), that commercial banks are required to retain as cash reserves with the Reserve Bank of India (RBI).

▪ The reserves must be held in cash form and apply to all scheduled commercial banks. For example, if Bank A receives 100 crores as deposits and the CRR is set at 3%, Bank A must deposit 3 crores in cash form with the RBI and is left with 97 crores for its operations.

▪ When the central bank increases the CRR, the amount of money available to banks decreases, and vice versa. The CRR funds must be kept in a vault within the bank or placed with the RBI.

▪ Section 42 of the RBI Act 1949 authorizes the RBI to announce a CRR between 3% to 15%, and this was later modified in 2007, removing the lower limit and allowing it to vary between 0-15%. As of December 2021, the CRR is set at 3%.

| CRR | Effect on money supply | Effect on economic growth |

|---|---|---|

| High | Low | Slow |

| Low | High | Fast |

Open Market Operation (OMO)

▪ Open Market Operations (OMO) is the buying and selling of government securities and treasury bills by the Reserve Bank of India (RBI).

▪ When the RBI sells government securities, it reduces the liquidity in the market, while buying government securities increases liquidity. Participation in OMO is open to all scheduled commercial banks and financial institutions, and the RBI has also allowed retail investors to invest in government securities by opening gilt accounts with the central bank. In April 2021, the RBI conducted an OMO operation that involved simultaneous buying and selling of government securities worth approximately Rs. 10,000 crores each.

Liquidity Adjustment facility

▪ The Liquidity Adjustment Facility (LAF) is a crucial monetary policy tool used by the Reserve Bank of India (RBI) to regulate the liquidity or money supply in the economy. It achieves this goal by allowing banks to either borrow money through repurchase agreements (repos) or lend loans to the RBI through reverse repo agreements.

▪ The LAF was introduced by the RBI in 1998 on the recommendation of the Narasimhan Committee on Banking Reforms. The LAF consists of two primary components: the Repo Rate and the Reverse Repo Rate.

Repo Rate

▪ The Repo rate is a key policy rate used by the Reserve Bank of India (RBI) to lend money to commercial banks. It is one of the components of the Liquidity Adjustment Facility (LAF) of the RBI.

▪ Banks can borrow at the Repo rate for different periods, ranging from overnight to 7 days or 14 days. When banks enter into a repurchase agreement with the RBI, they sell G-secs and agree to buy them back at a different rate on a future date.

▪ An increase in the Repo rate makes borrowing from the RBI less attractive for commercial banks, which may reduce liquidity and demand in the market. This is part of the contractionary monetary policy.

▪ In contrast, a decrease in the Repo rate may encourage banks to borrow and lend more to customers, increasing liquidity and demand in the market. This is part of the expansionary monetary policy.

▪ As of December 2023, the Repo rate stands at 6.25%.

Reverse Repo Rate

▪ The Reverse Repo rate is the rate at which the Reserve Bank of India (RBI) borrows from commercial banks. It is a part of the Liquidity Adjustment Facility (LAF) of the RBI. The Reverse Repo rate borrowing is generally available at 7 days, 14 days reverse repo rate.

▪ The RBI makes a repurchase agreement with the commercial banks and sells the securities, buying them back at a different rate than the agreed price. An increased reverse repo rate will encourage banks to lend to the RBI, reducing liquidity with the bank, and resulting in decreased lending activities and reduced demand in the market. It is a part of the contractionary monetary policy.

▪ Conversely, decreased reverse repo rate will encourage banks to lend to customers rather than lending to the RBI, increasing liquidity and demand in the market. This is a part of the Expansionary Monetary Policy.

▪ As of the December 2023 Monetary Policy Review, the Reverse Repo rate is set at 3.35%

Standing Deposit Facility (MSF)

▪ Marginal Standing Facility (MSF) is a monetary policy tool that allows banks to borrow overnight funds from the Reserve Bank of India (RBI) at a higher interest rate than the repo rate.

▪ The RBI introduced it in May 2011. To avail of overnight credit through MSF, banks must pledge securities to the RBI.

▪ The maximum credit a bank can avail through MSF is 3% of its net demand and time liabilities (NDTL). Banks can use securities held under the Statutory Liquidity Ratio (SLR) quota to borrow through MSF without paying a penalty, as it is considered an emergency measure. This helps banks avoid volatility in overnight inter-bank interest rates. The MSF rate in December 2023 is 6.75%.

Long-Term Repo Operation

▪ The Long-Term Reverse Repo Operation (LTRO) serves as a monetary policy instrument designed to enhance the effectiveness of monetary policy transmission and promote the smooth provision of credit within the economy.

▪ The LTRO is intended to inject liquidity into the financial sector, with the repo rate being used to provide funds. Banks can borrow for a period of one year and three years at the same one-day repo interest rate, but long-term loans generally have a higher interest rate than short-term (repo) loans.

▪ According to the RBI, the LTRO scheme will complement the Liquidity Adjustment Facility (LAF) and Marginal Standing Facility (MSF) operations. In February 2020, the RBI conducted LTROs for one- and three-year tenors worth up to a total of ₹ 1,00,000 crore at policy repo rates.

▪ The LTROs are carried out on the Core Banking Solution (E-KUBER) platform at a predetermined rate, and the minimum bid amount is Rs 1 crore, with no limit on individual bidders’ maximum bidding amount.

Market Stabilisation Scheme (MSS)

▪ The Market Stabilization Scheme (MSS) is a monetary policy tool used by the RBI to manage the money supply in the economy. Under this scheme, the RBI issues government bonds known as Market Stabilisation Bonds (MSBs).

▪ These securities are owned by the government even though they are issued by the RBI. The RBI, acting as the government’s banker, sells or issues government securities (bonds/treasury bills).

▪ The government lends its bonds or securities (MSBs) to the RBI for carrying out the MSS, and the RBI becomes a debtor to the government in the amount of the MSBs. However, the funds raised during MSS cannot be used by the government and must be kept in a separate MSS account to pay for bonds at maturity. The government pays interest on the MSBs. During demonetization, the RBI issued MSBs worth Rs. 6 lakh crores to withdraw excess liquidity.

Significance of Quantitative Tools

▪ Quantitative tools, as their name suggests, are connected with the amount and size of money. They are employed to control the total amount of money and bank credit accessible in the economy.

▪ These tools are not direct instruments, but they have an impact on the credit availability in the economy by influencing the supply and cost of money. As a result, they have an indirect effect on the level of aggregate demand.

Limitations of Quantitative Tools

▪ Frequent fluctuations in policy rates may create uncertainties among banks, resulting in ineffective transmission of monetary policy. Problems such as Non-Performing Assets have obstructed credit creation despite the use of Quantitative tools to boost liquidity. Relying solely on quantitative tools may not be enough to achieve the desired economic outcome, as there are many other factors that affect the money supply.

Qualitative Monetary Policy Instruments

Types of Qualitative Tools

▪ Following are the qualitative tools used by the RBI for credit control.

Change in Marginal Requirement

▪ Margin refers to the portion of a loan that is not financed or offered by the bank, expressed as a percentage. A change in the marginal requirement can result in a change in the loan amount. This tool is employed to increase the credit supply for necessary sectors while limiting it to non-essential sectors.

▪ This can be achieved by increasing the margin for non-essential sectors while decreasing it for sectors in need. If the RBI determines that the agricultural sector requires more credit, the margin will be lowered, and up to 80-90% of the loan amount will be available.

▪ For instance, if the marginal requirement for the agricultural sector is 10%, and someone offers collateral worth 10 crores for a loan of 10 crores, the maximum sanctioned amount will be 9 crores. However, for the automotive sector with a marginal requirement of 20%, for the same collateral and loan, the sanctioned amount will be 8 crores.

Regulation of Consumer Credit

▪ Consumer credit supply is managed through the instalment of sale and hires purchase of consumer goods, with predetermined features like instalment amount, down payment, and loan period.

▪ This mechanism helps in controlling credit and inflation in the country. For example, if the RBI establishes a minimum downpayment limit of 15% for a home loan, then for a loan amount of 1 crore, the borrower must pay Rs. 15 lakhs as a downpayment to avail of a loan of 85 lakhs.

Rationing of Credit

▪ Commercial banks are subject to a credit limit established by the Reserve Bank of India. The amount of credit available to each bank is restricted, and they must adhere to it.

▪ The RBI may set a higher credit limit for certain objectives, while also limiting the bank’s credit exposure to unfavourable industries.

▪ This tool also regulates bill rediscounting. For example, the RBI may instruct banks not to lend to traders of onion and potatoes, even if they are eligible and can pledge collateral. This is to prevent the hoarding of essential commodities using bank loans.

Moral Suasion

▪ Moral suasion is a tool used by the RBI to boost commercial banks to secure credit during inflationary periods. The RBI puts pressure on the Indian banking system without taking any concrete steps to ensure compliance with the rules.

▪ The central bank communicates its expectations to commercial banks through monetary policy. Through moral suasion, the RBI can issue orders, recommendations, and suggestions to reduce loan supply for speculative purposes.

▪ For example, if the Governor of RBI issues a press statement that repo rate cuts have not been passed on to consumers, this would encourage banks to reduce their interest rates.

Direct Action

▪ Commercial banks that fail to comply with the guidelines provided under the monetary policy may face punishment and sanctions from the central bank (RBI). The Prompt Corrective Action Framework is an example of a direct action measure that can be imposed.

What is Prompt Corrective Action (PCA) Framework? Prompt Corrective Action is a framework used by regulators to intervene in banks that are experiencing financial difficulties. The goal of PCA is to help banks address their problems early on, before they become more serious. PCA can involve a number of measures, such as: • Requiring the bank to raise capital • Limiting the bank's activities • Appointing a new management team • Placing the bank under conservatorship or receivership PCA is intended to protect depositors and creditors, and to prevent the failure of banks that could have a systemic impact on the financial system. The Reserve Bank of India (RBI) was introduced the PCA framework in 2002 and has been revised several times since then. The RBI has four stages of PCA, ranging from Stage 1 (least serious) to Stage 4 (most serious). Banks in Stage 1 and 2 are subject to regular monitoring, while banks in Stage 3 and 4 are subject to more stringent restrictions. PCA is an important tool for regulators to use to prevent bank failures. By intervening early, regulators can help banks address their problems before they become too serious. This can protect depositors and creditors, and can help to prevent the failure of banks that could have a systemic impact on the financial system.

Frequently Asked Questions (FAQs)

Monetary policy refers to the actions taken by a central bank or other monetary authority to regulate and control the money supply in an economy. The primary objective of monetary policy is to achieve and maintain price stability, i.e., to keep inflation under control, while also promoting economic growth and stability.

Expansionary and Contractionary monetary policy.

Expansionary monetary policy stimulates economic growth by increasing the money supply and lowering interest rates, while contractionary monetary policy slows down the economy and controls inflation by decreasing the money supply and raising interest rates.

The monetary policy of the Reserve Bank of India (RBI) aims to maintain price stability along with economic growth and development. The RBI uses various monetary policy tools, such as setting the benchmark interest rate (repo rate), changing the cash reserve ratio (CRR) and statutory liquidity ratio (SLR) for banks, and conducting open market operations (OMO).

Monetary policy is usually controlled by a country’s central bank, which is responsible for controlling and managing the money supply in the economy.

In the United States, for example, the Federal Reserve System (Fed) is the central bank that sets and implements monetary policy.

In India, the Reserve Bank of India (RBI) is responsible for regulating the country’s monetary policy.

Central banks use a variety of tools and techniques to influence the money supply and achieve their monetary policy goals, such as adjusting interest rates, changing reserve requirements for banks, and conducting open market operations. The specific structure and decision-making processes of central banks may differ from country to country.

The objectives of monetary policy can vary depending on the country and the specific economic conditions at the time. However, the general objectives of monetary policy include:

Price stability: One of the primary objectives of monetary policy is to maintain price stability, which involves keeping inflation under control. Central banks typically set an inflation target and use monetary policy tools to achieve this target.

Economic growth: Another important objective of monetary policy is to promote economic growth and development. This can be achieved by encouraging investment and consumption through measures such as lowering interest rates.

Full employment: Monetary policy can also be used to promote full employment by stimulating economic activity and creating job opportunities.

Financial stability: Central banks may also use monetary policy to maintain financial stability by regulating the flow of credit in the economy and preventing excessive risk-taking.

Exchange rate stability: Maintaining stability in the exchange rate of a country’s currency is another objective of monetary policy. This can be important for promoting international trade and investment.

More Topics on the Indian Economy

Mixed Economic System: Characteristics, Examples, Pros & Cons

Regional Rural Banks in India: History, List, Function, and Key Points

Major Flagship Schemes of the Government of India: Important List

RBI Governors List from 1935 to 2024: Name, Eligibility, Powers, Tenure Complete Guide

Indian Currency Notes and Coins: Symbol, New Currency, Press & Mints